Today’s dynamic, digital, and global world plays out in all aspects of our personal and business lives. In the field of financial forensics, these realities show themselves in the rising industries we engage in and the approaches we use to get to the truth.

As we reflect on the year past and what’s ahead in 2019, there are many trends that catch our attention. Here are just a handful:

1. Big Data Analytics Driving Speed and Precision

When it comes to financial forensics, traditional data analytics has been the standard for helping to guide the focus and patterns of investigations and valuations. Today, the trend is big data analytics. Big data is upping the game to provide access to vast amounts of unstructured data that would otherwise require extremely manual, time-consuming work to bring to analyze.

One area we’re seeing big data analytics prove hugely valuable is in insurance claims accounting where the pressure to cut costs, control fraud, and speed claims time resolution is higher than ever.

2. Forensic Accountants as Cybersecurity Experts

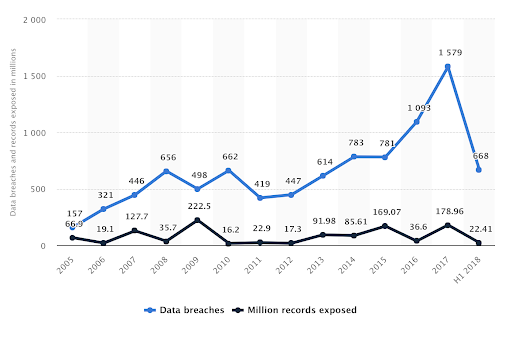

Research from IBM that found the average cost of a data breach in the U.S. in 2018 exceeded $7 million. The global average cost was $3.86 million. While the U.S. has taken the brunt of the cyber breach impact, in December 2018, Security Boulevard stated its prediction that data breaches will become more of a global phenomenon. Terry Ray of Security Boulevard wrote, “What you’ll see in 2019, and certainly, as we move forward, is a red rosy glow covering the entire globe. In 2019 you’ll hear more of ‘It’s not just the United States. This happens everywhere.’”

While data breaches are just one aspect of cybersecurity, their impact and frequency serve as a powerful example of the growing cybersecurity threat forensic accounting experts will continue to be called to unravel. And as AccountingEdu.org explained, “As blockchain and other novel technologies become more commonly adopted, the gap between cybersecurity specialists and forensic accountants will shrink even further.”

3. Forensic Accountants Gaining Comfort with the Uncertainty of Cryptocurrency

Transactions in the cryptocurrency space have an intrinsic level of uncertainty and limited information, which has made the job of financial forensics outside the comfort zone for many practitioners. Increasingly, however, forensic accountants are honing their craft and gaining expertise to more quickly verify transactions in this space.

4. Insurance Coverage for Cannabis Driving Need for Forensics Support

Momentum and growth in the cannabis industry is not expected to let up anytime soon. And it’s spilling over into an increasing demand for insurance services. The legal cannabis market was worth an estimated $7.2 billion in 2016 and is projected to grow. Medical marijuana sales are expected to grow from about $4.7 billion in 2016 to $13.3 billion in 2020. And adult recreational sales are estimated to jump from about $2.6 billion in 2016 to $11.2 billion by 2020. (Source: Forbes)

The insurance sector is feeling the impact of this growth as dispensaries, processors, manufacturers, distributers, storage facilities, and others operating in the cannabis industry seek coverage and claims departments seek forensics support.

5. Automate, Automate, Automate

Automation is a huge trend in seemingly every industry and financial forensics is no exception. As the demand of insurers continues to emphasize speed, low cost, and precision, automation of claims validation will be an essential capability for forensic accounting providers.

It’s an exciting and challenging time to operate in the world of financial forensics. We look forward to what 2019 will bring and invite you to start a discussion with us about the trends that will impact your business most in the year ahead.